⚠️

Important Warning

Your Home’s Surplus Funds Could Be Taken by the Government After Foreclosure — Don’t Lose What’s Rightfully Yours.

Reclaim What’s Rightfully Yours: Don’t let your hard-earned equity end up in the State’s hands after foreclosure. There’s only a limited time to claim your surplus funds — the money left over after your home is sold.

Join countless homeowners who have already recovered what’s theirs with Money After Foreclosure. Act now to protect your equity and secure your financial future!

⚠️

Important Warning

Your Home’s Surplus Funds Could Be Taken by the Government After Foreclosure — Don’t Lose What’s Rightfully Yours.

Reclaim What’s Rightfully Yours: Don’t let your hard-earned equity end up in the State’s hands after foreclosure. There’s only a limited time to claim your surplus funds — the money left over after your home is sold.

Join countless homeowners who have already recovered what’s theirs with Money After Foreclosure. Act now to protect your equity and secure your financial future!

4 Easy Steps To Reclaim Your Home Equity Funds

Step 1

Schedule a Free Consultation

Begin with a no-obligation call to review your property details with a claims specialist at Money After Foreclosure.

We’ll explain how the process works, confirm if you’re eligible for surplus funds, and outline the next steps to help you reclaim what’s yours.

Step 2

Effortless Claim Filing

Once you qualify, we’ll handle the entire claim process for you.

Our experienced team manages all the legal paperwork and court filings on your behalf — so you don’t have to worry about a thing.

And best of all, you pay nothing unless we successfully recover your funds.

Step 3

Stay Informed

We’ll keep you updated every step of the way.

Expect regular updates from Money After Foreclosure as your claim progresses — and confirmation once your surplus funds are approved.

Step 4

Receive Your Funds

Once approved, you’ll receive your surplus funds check directly.

Simply deposit it and enjoy the peace of mind that comes with reclaiming what’s rightfully yours.

Success Stories

Looking for a trusted partner to help you recover your surplus funds? Money After Foreclosure has helped countless homeowners reclaim what’s rightfully theirs.

See some of our real success stories and actual checks from satisfied clients who turned their foreclosure losses into financial relief.

Your story could be next!

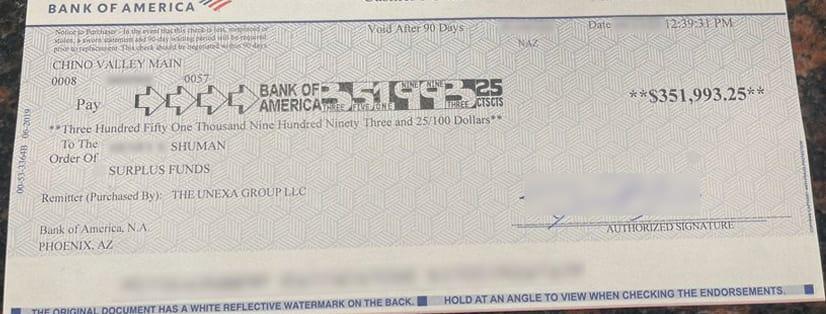

Mr. Shuman - $351,993.25

Mr. Shuman is a resident in Los Angeles, CA and unfortunately, due to health issues, his home went into foreclosure unexpectedly. Mr. Shuman is 89 years old and thankfully, because we were able to save his equity from loss to the State, he’ll be using the money towards his nursing home care.

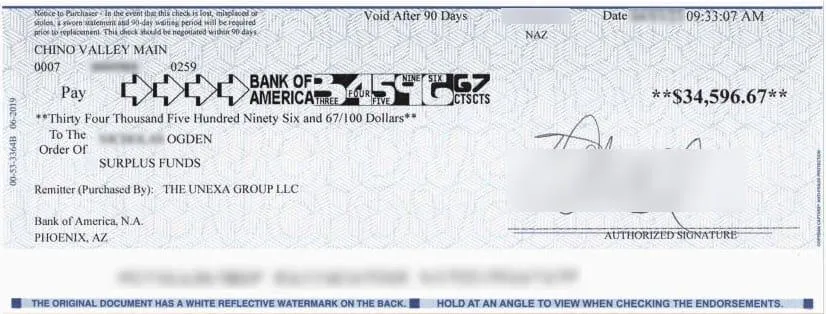

Mr. Ogden - $34,596.67

Nicholas was the beneficiary of his mother’s home equity from her house in Madres, Oregon after her passing. After working with Nicholas and navigating all the legal procedures in the claims process, we were able to help him save what his mother had left behind for him. This check for $34,596.67 enabled Nicholas to pay for a new place to live in.

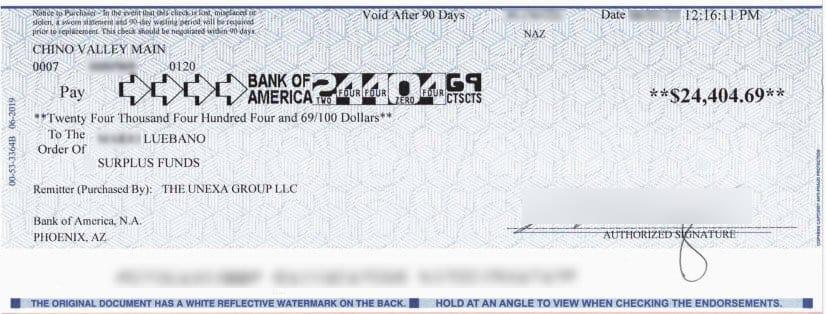

Mr. Luebano - $24,404.69

We were able to swiftly help Mr. Luebano recover the home equity from his property in San Antonio, Texas before the funds were deposited with the State.

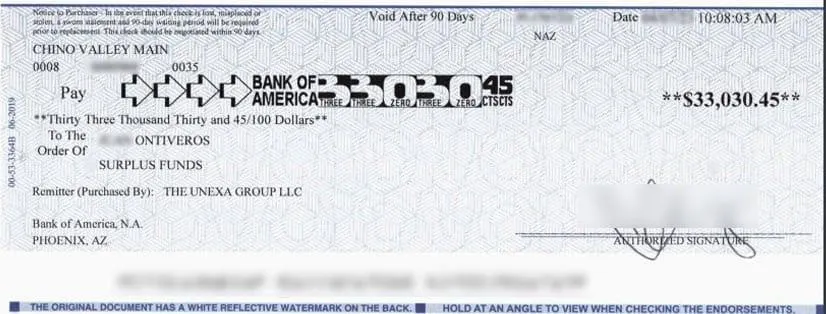

Mr. Ontiveros - $33,030.45

Mr. Oliveros reached out to us to save his home equity following foreclosure. After losing his wife to illness, he was able to share the equity with their children, Ashley and Miranda.

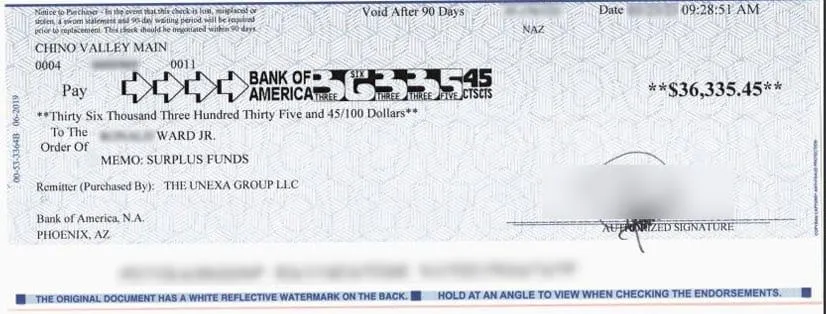

Mr. Ward Jr. (beneficiary)

We were able to help Mr. Ward recover the equity from his parent’s Texas property who were deceased. About half of our cases consist of working with loved ones of deceased property owners, and helping them get closure on their loved ones assets while preventing their equity from being absorbed by the States Unclaimed Property Division.

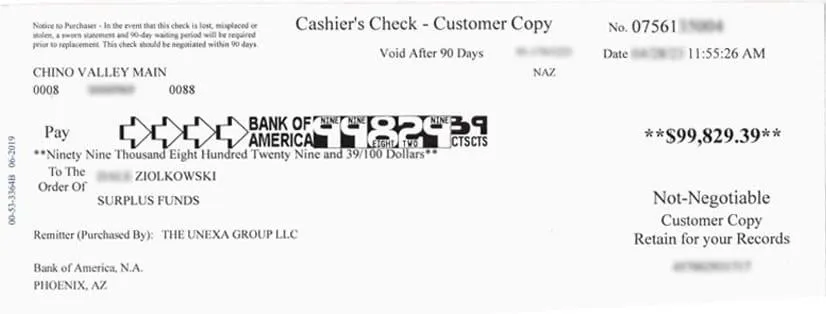

Mr. Ziolkowski - $99,829.39

Mr. Ziolkowski was facing foreclosure for two of his homes, here is a copy of the check stub on one of them in Longview, Washington. With the equity from both houses, he was able to invest in his family’s future living situation.

Our No-Risk Guarantee: You Only Pay When We Win

At Money After Foreclosure, your financial recovery is our priority.

Our promise is simple — if we don’t recover your surplus funds, you don’t owe us a dime. There are no upfront costs, no hidden fees, and no risks. We only get paid when we successfully reclaim your money — because your success is our success.

Trusted by Many, Proven by Results

At Money After Foreclosure, we understand that trust can be hard to find — especially after losing your home. That’s why we let our client results, verified success stories, and glowing reviews do the talking.

Over the years, hundreds of homeowners have turned to us to recover their surplus funds, rebuild their financial foundation, and regain the peace of mind they deserve.

Our consistent results and honest approach have made us one of the most trusted names in foreclosure surplus recovery.

💰 No Upfront Fees | ⚖️ Licensed Claims Specialists | 🏠 Millions Recovered for Homeowners Nationwide | 📞 Personalized Support

⭐⭐⭐⭐⭐

Money After Foreclosure walked me through everything and handled all the paperwork. I got a call that my check was on the way — $17,200 deposited in just six weeks. I can’t thank them enough!

- Maria G., Phoenix, AZ

⭐⭐⭐⭐⭐

I was sure the state had my money for good. These folks found $19,750 that I didn’t even know existed. Zero stress, no upfront fees — highly recommended.

- Jerome R., Atlanta, GA

⭐⭐⭐⭐⭐

The team kept me updated the whole time and answered every question. They recovered $18,100 for me and made a difficult situation feel manageable.

- Linda S., Cleveland, OH

⭐⭐⭐⭐⭐

I appreciated the clear timeline and honest communication. From the free consult to receiving my check ($16,400), everything was handled professionally.

- Carlos M., San Antonio, TX

⭐⭐⭐⭐⭐

After foreclosure I thought there was nothing left. Money After Foreclosure proved me wrong — I received $22,850 and didn’t pay a cent until they recovered it.

- Heather P., Tampa, FL

Regain What’s Rightfully Yours — Start Your Surplus Funds Recovery Today

If you’ve recently gone through foreclosure, don’t lose hope. You may still be entitled to thousands of dollars in surplus equity that the State could be holding. At Money After Foreclosure, we specialize in locating and reclaiming these hidden funds — helping homeowners like you recover what’s rightfully theirs. But time is critical. The window to claim your surplus funds is limited.

Act now — reach out today and let our team help you secure the money that belongs to you.

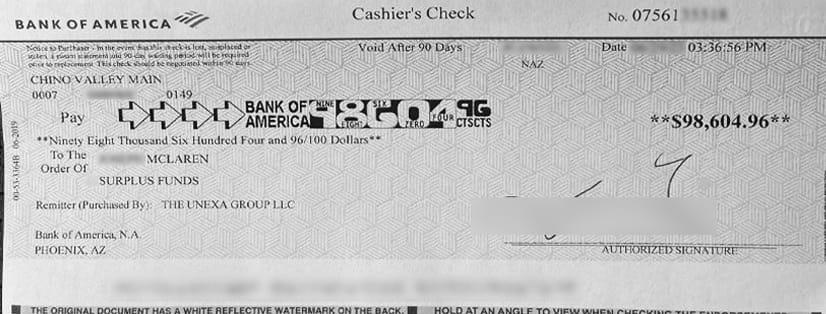

Mr. Mclaren - $98,604.96

Mr. Mclaren is an elderly man with many health issues, unfortunately he and his daughter were unable to pay their mortgage and lost their home due to foreclosure. Shortly after, they were served with an eviction notice. Unexa was able to negotiate a longer stay in the property until they received this check for $98,604 that helped them with relocating to a new home.

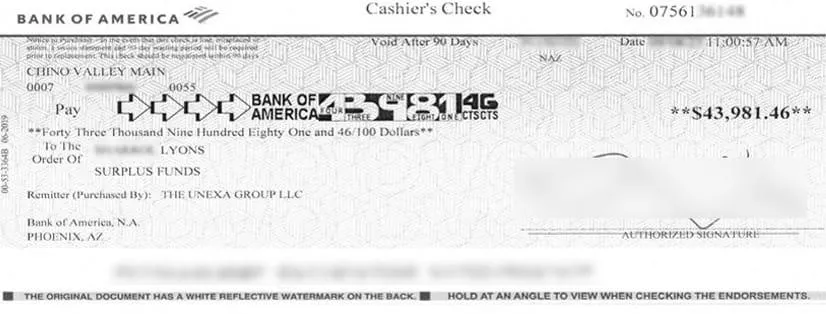

Ms. Lyons - $43,981.46

Ms. Lyons, a property management professional, fell victim of foreclosure after undergoing personal hardships in her life. Thankfully, we were able to save her equity before it was too late. Now, Sharrol is in a better position financially and has regained her life.

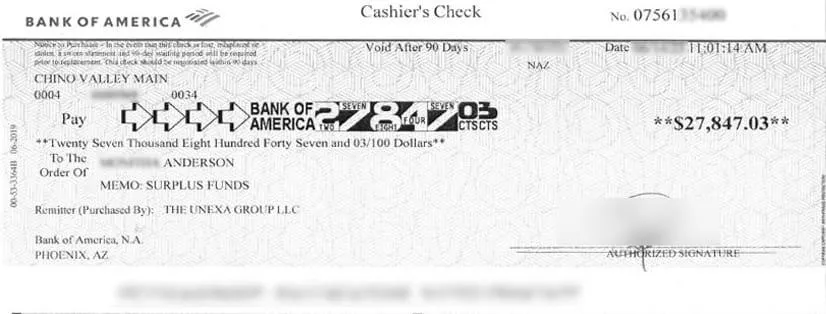

Ms. Anderson - $27,847.03

Ms. Anderson encountered a bump in the road in their relationship. After several months of separation, and turmoil, the couple decided to let go of their financial obligation to their mortgage payments. Fortunately, since then, the two decided to rekindle their relationship and used the equity generated from foreclosure to fund their new apartment together.

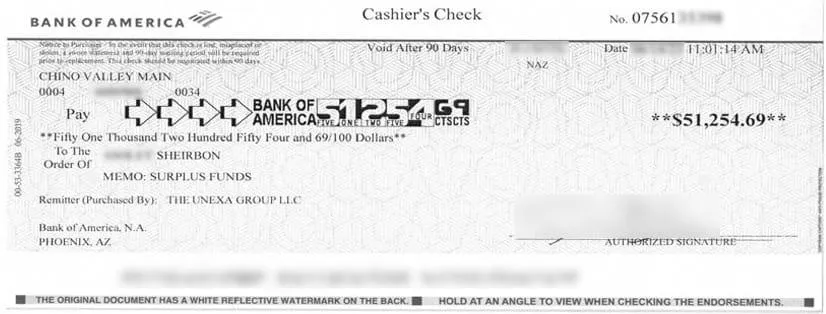

Ms. Sheirbon - $51,254.69

Ms. Sheirbon was suffering from mental health issues after the passing of her father, and losing his home to foreclosure shortly after. At first, she refused to accept the reality of the situation, which is common, and decided to stay in the property and delay her claim to the funds. The Unexa team remained patient and was there for moral support and questions. After several weeks, Ashley filed her claim with us, and was given the financial means through her fathers home equity, to move on peacefully.

Ready to Take the First Step?

Click the button below to begin your surplus funds recovery journey.

With Money After Foreclosure, you’re not just reclaiming your funds — you’re reclaiming your peace of mind.

Let’s get started today and secure the money that rightfully belongs to you.

Money After Foreclosure

Helping Families Reclaim What’s Rightfully Theirs

Here at Money After Foreclosure, our team helps families and individuals recover surplus funds left behind after foreclosure. Our experienced team makes a usually very difficult process very simple, transparent, and stress-free. Turning financial loss into financial recovery

At Money after Foreclosure have a strong team with over 40 years of combined experience in Real Estate Law. Our success is reflected in the numbers. Our approach is personal. We don’t see our clients as just cases; they are families with their own stories and challenges. Our team, consisting of knowledgeable Foreclosure Consultants, Attorneys, and Paralegals, works tirelessly to provide the best possible outcome for each family. We’re not just recovering funds; we’re rebuilding lives and restoring hope.

1500+

Successfully

completed cases

40+

Years of combined

experience

$100 MM+

In Assets

Recovered

Frequently Asked Questions

What are surplus funds after foreclosure?

Surplus funds are the remaining money from a foreclosure sale after the mortgage and legal fees are paid off. That leftover amount rightfully belongs to the former homeowner — and it must be claimed before the State keeps it.

How do I know if I have surplus funds owed to me?

Our team can verify this for you at no cost. During your free consultation, we’ll research your property records to determine whether any surplus funds are being held in your name.

Is there a deadline to claim my surplus funds?

Yes. Each state has strict time limits for claiming surplus funds — often between 6 months and 2 years after the foreclosure. Waiting too long could cause you to lose access permanently, so it’s best to act quickly.

What does it cost to work with Money After Foreclosure?

There are no upfront costs at all. Our service operates on a success-based model — we only get paid once we successfully recover your funds. If we don’t win, you pay nothing.

How long does the process take?

Every case is different, but most clients receive their funds within 4 to 8 weeks after filing. We’ll keep you updated every step of the way so you always know where things stand.

What information do I need to start the process?

Every case is different, but most clients receive their funds within 4 to 8 weeks after filing. We’ll keep you updated every step of the way so you always know where things stand.

Can I claim the funds myself without help?

Technically yes, but the process can be confusing and full of legal steps. Many homeowners lose their claim because of missing paperwork or missed deadlines. Our experienced claims specialists make sure it’s done correctly — and quickly.

What if the foreclosure happened years ago?

It’s still possible you’re owed money, depending on state laws and court timelines. We’ll check your case for free to see if funds are still available to claim.

Is this really legitimate? It sounds too good to be true.

Yes — surplus fund recovery is 100% legitimate. These funds are held by government agencies or court systems after a foreclosure. We simply help homeowners claim what legally belongs to them — with full transparency and no risk.

© 2025 – Money After Foreclosure. All rights reserved. All rights reserved. Policy